Article

Dear Investors,

We are proud to publish our first S&B Bankers debt rating review where we will evaluate Lithuanian banking industry players. Our review consist of three main parts: Current economic & political climate, S&B rating methodology and ratings of Lithuanian bankers.

CURRENT ECONOMIC & POLITICAL CLIMATE

In this part of our review we will try to shortly summarize sLithuania's current economic conditions and developments in order to be able to evaluate liquidity prospects of rated bankers.

Prices: since last week we can see decline in prices of raw commodities and finished products. According Lithuania's Statistics department research this decline could be met practically in every production group/category. At the same time decrease in prices is driving workers salaries down (what has both sided effects - decrease in production costs, but at the same time - deterioration in consumers purchasing power).

Production supplies: due to the fact, that for several past days Lithuania is not actively engaged in war actions production stocks and warehouses are stuck with thousands of unsold products. This means that it is getting much harder to have positive cash flows even for prominent manufacturers and entrepreneurs.

Law Makers survey: S&B surveyed 7 Law makers what is their * opinion * on the following questions:

How likely that sLithuania will actively engage in war actions in upcoming 7 days?

How likely that sLithuania will actively engage in war actions in upcoming 15 days?

How likely that sLithuania will actively engage in war actions in upcoming 30 days?

* Any of the stated opinion is purely personal opinion of surveyed Law makers and doesn't represent official or any other opinion of sLithuania Congress or Government. *

This survey will be used as one of measurement indicators to evaluate production liquidity of rated bankers.

METHODOLOGY

While running examination of Lithuanian bankers we were using several criteria to determine final S&B rating for single banker:

1) Personal history;

2) Debt repayment history;

3) Business portfolio;

4) Active debt & loans.

For every criteria above we assigned one of the following ratings:

BBB - Triple Boobs - highest possible investment rating. Safe to deposit you gold

BB - Double Boobs - still solid investment rating. Safe enough investment option

B - Single Boobs - average investment rating. Still could be a decent investment option, but it has higher risk. Be more careful while investing here

D - Single D - non investment rating. During successful economic event could bring high profit, but is extremely risky and we don't recommend to invest here

N/A -not rated. Was not enough data to rate the banker or he didn't provide necessary information

S&B BANKERS DEBT RATINGS

Personal history: Was born in 94th e-sim day. Started his banking career 1 month ago. Previously known as

Debt repayment history: Was hacked once read here . Otherwise debts were repaid on time (according publicly known information). S&B Rating - BB

Business portfolio: Currently owns Q5, Q3 iron and Q3 diamond companies. With current market prices banker is able to earn 4.91 Gold if he can sell all his production. Which is unlikely due to low demand and overproduction of raw materials (banker should have approximately ~10K of iron in his warehouse according our calculations and information provided by him. This is equal to 52 Gold frozen in stocks). S&B Short term (~15 days) Rating - BB (taking into account current market conditions). S&B Long term (30+ days) Rating - BBB

Active debt and Loans: Banker has ~601 Gold Short term (up to 15 days) and ~161 Gold Medium to Long term (more than 15 days) active debt. Information about active loans is not known to S&B.

In calculations of Cash flow we made an assumption that banker is able to sell his production stocks. Also we included information about his Gold and other currency reserves (provided by respective banker). Still this projection is quite theoretical and should be taken into consideration with great caution. New deposits and/or successful market developments could change Cash flow projection dramatically. S&B Short term (less than 15 days) Rating - BBB (taking into account current market conditions). S&B Long term (More than 15 days) Rating - B

Other remarks: The rated banker is trying to attract additional capital to be able to pay off his long term debts and to expand his banking business through this Game .

Final rating: S&B appoints to

----------------------------------------------------------------------------------------------------------------------------------

Personal history: Was born in 32th e-sim day. Started his banking career few days ago. S&B Rating - B

Debt repayment history: Not known (according publicly known information). S&B Rating - B

Business portfolio: Currently owns Q5 gifts company. With current market prices banker is able to earn 1.46 Gold if he can sell all his production. S&B Short term (~15 days) Rating - B (taking into account current market conditions). S&B Long term (30+ days) Rating - BBB

Active debt and Loans: Banker has 213.16 Gold Short term (up to 15 days) and 104.52 Gold Medium to Long term (more than 15 days) active debt. Information about active loans is not known to S&B.

In calculations of Cash flow we made an assumption that banker is able to sell his production. Also we included information about his Gold and other currency reserves (provided by respective banker). Still this projection is quite theoretical and should be taken into consideration with great caution. S&B Short term (less than 15 days) Rating - BB. S&B Long term (More than 15 days) Rating - BB

Final rating: S&B appoints to

----------------------------------------------------------------------------------------------------------------------------------

Personal history: Was born in 5th e-sim day. Started his banking career on 9th day. More info here. . S&B Rating - BBB

Debt repayment history: According publicly known information is as clean as snow. S&B Rating - BBB

Business portfolio: Currently owns 4xQ5 iron, 3xQ5 & 2xQ1 wep, 2xQ & Q4 grain, 2xQ5 & Q4 diamond, 2xQ5 gift and Q4 oil companies. With current economic conditions banker is meeting liquidity problems and should have more than 132 Gold frozen in stocks. With current market prices banker is able to earn 65.30 Gold if he can sell all his new production. S&B Short term (~15 days) Rating - B (taking into account current market conditions). S&B Long term (30+ days) Rating - BBB

Active debt and Loans: Banker has 6589.25 Gold Short term (up to 15 days) and 2394.14 Gold Medium to Long term (more than 15 days) active debt. Banker has Gold 1136.8 active loans mostly maturing in ~15 days.

In calculations of Cash flow we made an assumption that banker is able to sell his production. Also we included information about his Gold and other currency reserves (provided by respective banker). Still this projection is quite theoretical and should be taken into consideration with great caution. If depositors will trust respective banker he should be able to meet his obligations. S&B Short term (less than 15 days) Rating - BB. S&B Long term (More than 15 days) Rating - BBB

Final rating: S&B appoints to

----------------------------------PUBLIC AND PRIVATE INTERESTS DECLARATION---------------------------------

On 145th day

* Any of the above mentioned contracts do not express opinion of S&B and is purely personal affair and experiment of Pukuveras. S&B does not posses any obligations to any of the bankers mentioned in the review and is representing fair and open evaluation of Lithuanian banking industry. *

----------------------------------------------------------------------------------------------------------------------------------

* Opinion presented by S&B is just a guidance or recommendations and the final decision to deposit with the mentioned bankers or not is up to depositor. *

Previous article:

[Cash&Boobs] S&B Bankers debt rating (13 years ago)

Next article:

[Cash&Boobs] S&B Bankers debt rating review #2 (13 years ago)

About the game:

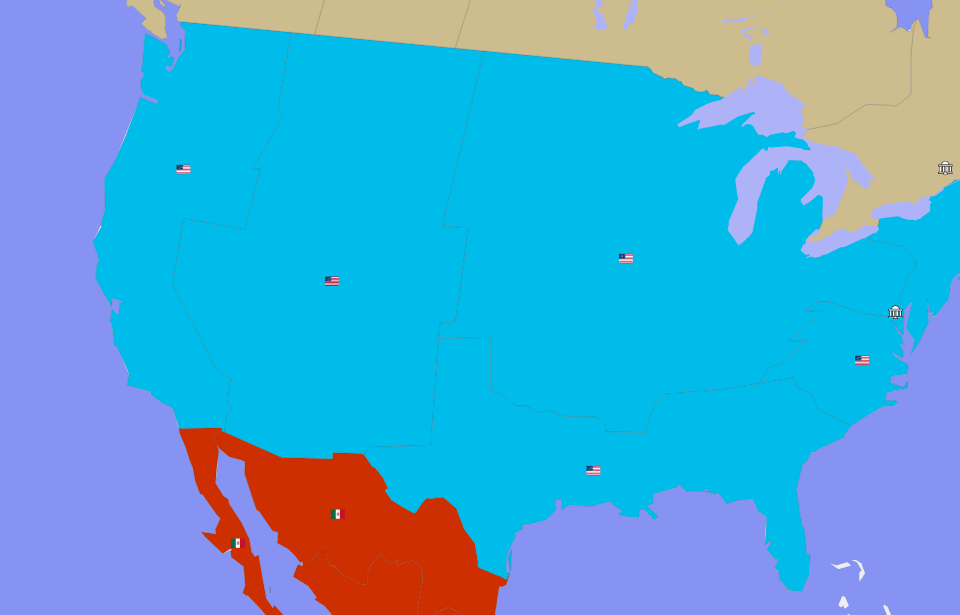

USA as a world power? In E-Sim it is possible!

In E-Sim we have a huge, living world, which is a mirror copy of the Earth. Well, maybe not completely mirrored, because the balance of power in this virtual world looks a bit different than in real life. In E-Sim, USA does not have to be a world superpower, It can be efficiently managed as a much smaller country that has entrepreneurial citizens that support it's foundation. Everything depends on the players themselves and how they decide to shape the political map of the game.

Work for the good of your country and see it rise to an empire.

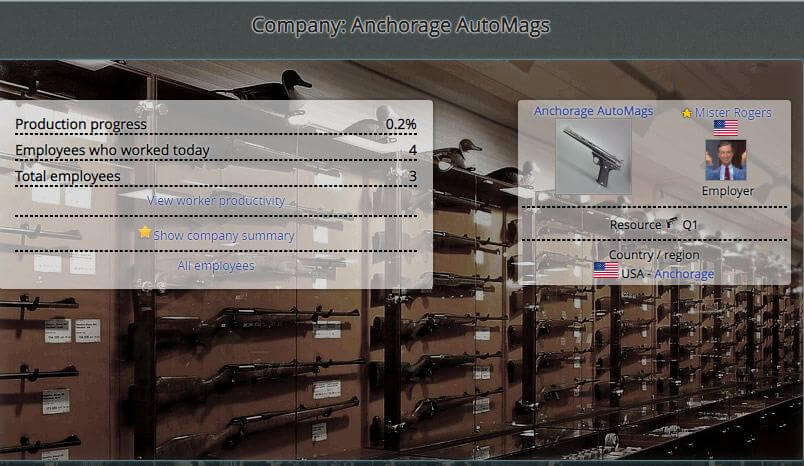

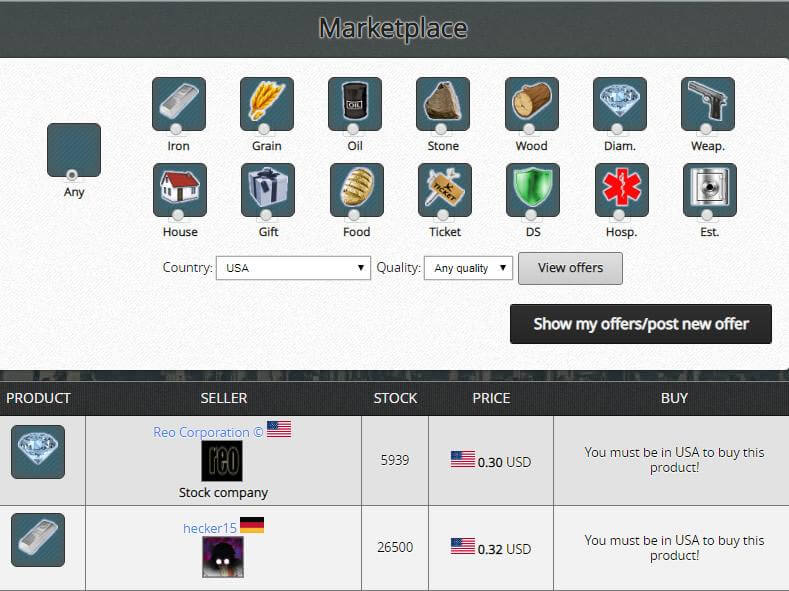

Activities in this game are divided into several modules. First is the economy as a citizen in a country of your choice you must work to earn money, which you will get to spend for example, on food or purchase of weapons which are critical for your progress as a fighter. You will work in either private companies which are owned by players or government companies which are owned by the state. After progressing in the game you will finally get the opportunity to set up your own business and hire other players. If it prospers, we can even change it into a joint-stock company and enter the stock market and get even more money in this way.

In E-Sim, international wars are nothing out of the ordinary.

Become an influential politician.

The second module is a politics. Just like in real life politics in E-Sim are an extremely powerful tool that can be used for your own purposes. From time to time there are elections in the game in which you will not only vote, but also have the ability to run for the head of the party you're in. You can also apply for congress, where once elected you will be given the right to vote on laws proposed by your fellow congress members or your president and propose laws yourself. Voting on laws is important for your country as it can shape the lives of those around you. You can also try to become the head of a given party, and even take part in presidential elections and decide on the shape of the foreign policy of a given state (for example, who to declare war on). Career in politics is obviously not easy and in order to succeed in it, you have to have a good plan and compete for the votes of voters.

You can go bankrupt or become a rich man while playing the stock market.

The international war.

The last and probably the most important module is military. In E-Sim, countries are constantly fighting each other for control over territories which in return grant them access to more valuable raw materials. For this purpose, they form alliances, they fight international wars, but they also have to deal with, for example, uprisings in conquered countries or civil wars, which may explode on their territory. You can also take part in these clashes, although you are also given the opportunity to lead a life as a pacifist who focuses on other activities in the game (for example, running a successful newspaper or selling products).

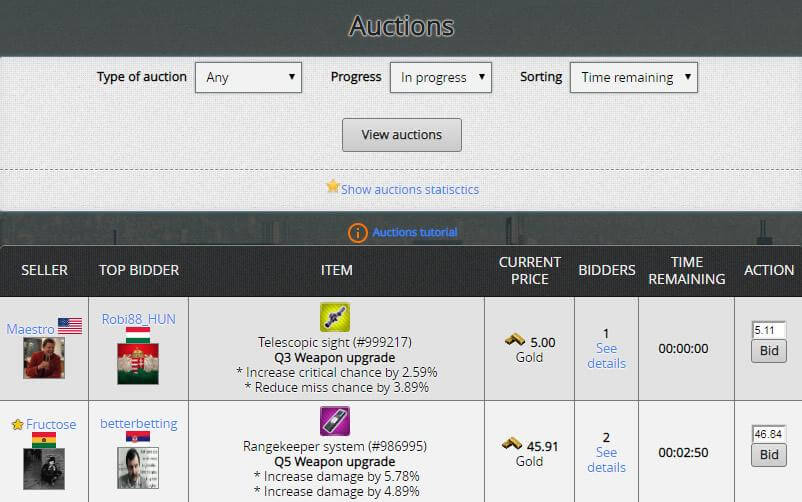

At the auction you can sell or buy your dream inventory.

E-Sim is a unique browser game. It's creators ensured realistic representation of the mechanisms present in the real world and gave all power to the players who shape the image of the virtual Earth according to their own. So come and join them and help your country achieve its full potential.

Invest, produce and sell - be an entrepreneur in E-Sim.

Take part in numerous events for the E-Sim community.